Fear & Greed – A Market Update by RBC Brewin Dolphin

By RBC Brewin Dolphin

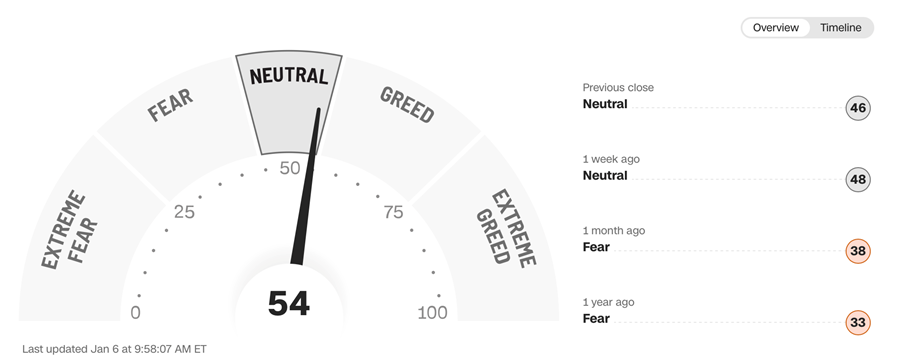

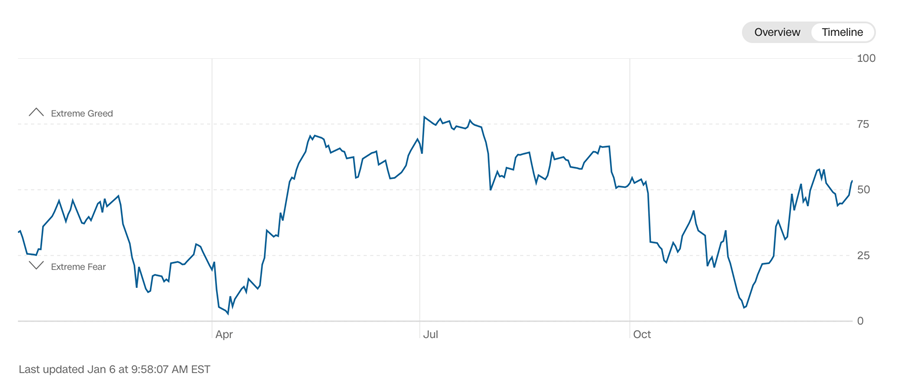

As 2025 disappears into the rear-view mirror, 2026 comes over the horizon. As you may be aware, our friends at CNN produce the Fear and Greed Index, which seeks to provide a visual representation of where we sit. It uses a number of metrics to provide a simple overview of those two basic motivators of investor behaviour, with markets tending to rise when investors feel greedy and fall when they feel fearful.

So, where do we sit at the moment?

Maybe unsurprisingly, after a year of peaks and troughs (as you can see below), the year finished with what can best be described as a pause for breath:-

So, not much to see then?

We wouldn’t say that! US action in Venezuela is a stark reminder that, just when you thought you could relax, events can happen that can create new environments. The seizing of President Maduro raises so many questions, not least the longer-term effect on oil, on US relations in Latin America and on global geopolitics. After all, it becomes a little difficult to complain about other countries’ behaviour when you have been a little cavalier with international rules yourself! There is also the “what next” question.

OK. What next?

It is relatively easy to get embroiled in situations, but history is full of examples of the difficulty of getting out again. What does winning look like? And if you cannot win, how can you withdraw while keeping as much face as possible? Does your intervention actually become counterproductive, as it hardens opinion against you? At present, given the collapse in the Venezuelan oil industry and the effect that sanctions have had over many years, the short-term economic effects have been muted. However, given the mercurial nature of Donald Trump, does he become newly emboldened on the international stage and turn his attention to Cuba or even Greenland?

What about those tariffs?

Donald Trump has continued to use tariffs as a bargaining tool and this is likely to continue, although every application and subsequent negotiation makes markets more sanguine about them. This might be a naïve reaction, as tariffs both create brakes to growth and raise international tensions, neither of which are particularly good for markets. That said, companies – like people – have shown themselves to be adaptable to changing circumstances.

What is the outlook for the year ahead?

In a year of many challenges, portfolios delivered good returns over the last year, but progress this year is likely to be more muted. Economies are struggling to make solid headway, as much down to weakness in consumer spending in China and the US as to broader economic activity. This is positive, of course, for interest rates which seem to be on a downward trend, but less so for employment levels. That said, company profits look likely to remain solid, albeit that this is truer for some sectors than others. As you can imagine, retailers are finding markets challenging, while those involved in the boom in investment in Artificial Intelligence look well underpinned.

How long will this AI boom last?

The jury is still out on what the exact effects of AI will be. Every day seems to feature a new announcement of changes that we can expect, but, as a commentator pointed out, new changes are announced before the previously announced changes have even been implemented. So, is it all bark and no bite? Well, the levels of investment are huge, so clearly there is an expectation that there will be some delivery, especially financial. Interestingly, the areas most affected at the moment are entry-level jobs – presumably ones which are, by definition, relatively easier – where automation is being introduced. It does rather beg the question that, if we no longer have people doing entry level jobs, where will people develop the skills to do more demanding roles in the future? That all said, we are reaching the point where those companies investing in expanding their capabilities in AI will be looking for a return on that investment to justify their spending.

Any other clouds on the horizon?

Until the last few days, we think we could fairly have said that the geopolitical situation was improving. A ceasefire in Gaza and increasing signs that Russia and Ukraine are getting closer to establishing a negotiating position, if not actually sitting around a table, are positive. The recent US actions have certainly upset this and attention will now focus on whether it will embolden other more autocratic regimes to take action themselves. It will be interesting to see how the situation unfolds in Iran.

And opportunities?

We have commented before that AI is incredibly energy-hungry, so infrastructure spending on power generation is still essential. Equally, a deterioration in the geopolitical environment is likely to see defence enhancements continue to be a focus for government spending, especially in Europe. Despite a strong run over the last few years, Gold is also likely to remain popular as a defensive investment. No doubt as the year progresses, some things which seem probable will become less so and be replaced by other opportunities.

In summary?

As ever, in an uncertain world, a well-diversified portfolio – both geographically and by industry – is the most sensible strategy. This, coupled with a focus on the kind of blue-chip companies that can demonstrate robust characteristics should continue to provide some protection from the inevitable changes ahead of us.

Important information

About RBC Brewin Dolphin

RBC Brewin Dolphin is one of the UK and Ireland’s leading wealth managers and traces its origins back to 1762. With £57.6bn* billion in assets under management, it offers award-winning, bespoke wealth management services, including discretionary investment management and financial planning.

Its qualified investment managers and financial planners are based in over 30 offices across the UK, Jersey and Republic of Ireland, with a commitment to high standards of client service, long-term thinking and absolute focus on clients’ needs at the core.

As part of Royal Bank of Canada (RBC), RBC Brewin Dolphin is now able to draw on the strength of a global financial institution to enhance the services it provides to clients and to drive further innovation across the business.

*as at 31st October 2024.

Disclaimers

The value of investments can fall and you may get back less than you invested.

RBC Brewin Dolphin is a trading name of RBC Europe Limited. RBC Europe Limited is registered in England and Wales No. 995939. Registered Address: 100 Bishopsgate, London EC2N 4AA. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

About RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 98,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada’s biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our more than 19 million clients in Canada, the U.S. and 27 other countries. Learn more at rbc.com.