US Election Update

By Rathbones

Former President Donald Trump has retaken the White House on a policy of widespread tax cuts, reduced immigration and lessened regulation. Bond investors aren’t happy, but shareholders are.

Donald Trump’s dramatic comeback victory will allow him to enact an updated version of his ‘America First’ agenda. That would mean looser fiscal policy, higher tariffs and restricted immigration, all of which add to the possibility of US inflation staying higher for longer.

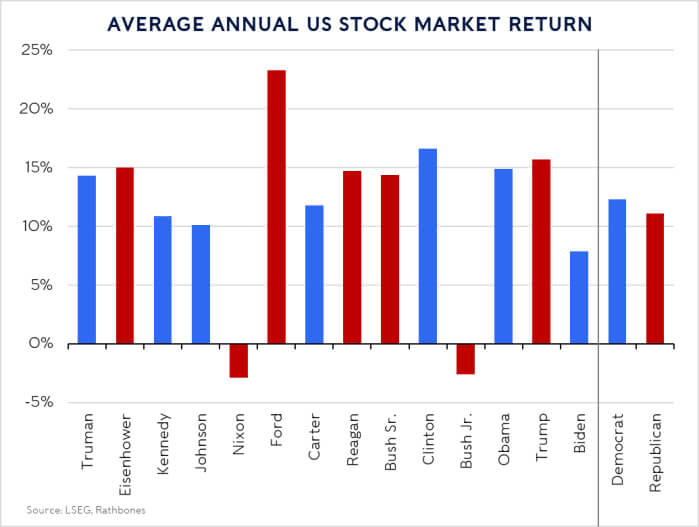

Higher-than-expected inflation increases risks for US government bonds, which have already come under pressure. In contrast, US stocks have so fargenerally welcomed Trump’s return, supported by the prospect of lower corporate taxes. And it’s worth remembering that they performed very well through his first term despite the start of the trade war with China –although the backdrop was arguably more favourable then, with more room to cut corporate taxes and inflation less of a concern.

More broadly, though, it’s important to keep the full impact –both negative and positive –of Trump’s agenda in perspective.Trump’s return is a seismic historical moment. But if there’s one thing the last few years in markets have shown clearly, it’s that the most important drivers of investment performance are things beyond the direct control of any US president. For long-term investors, it’s vital to maintain that broader perspective as markets react to the election result, particularly when it comes to the choice of individual stocks and sectors.

Key Takeaways

- .US corporate taxes could fall to from 21% to 15%, boosting US equities

- .Expensive tax cuts for small businesses and households dating to 2016 to remain

- .Government spending above tax receipts likely to remain very large

- Tariffs are likely to rise, with rates of 60% and more on Chinese imports proposed

- Imports from the rest of the world could be subject to higher levies of 10-20%

- Immigration to be severely curtailed

- Deregulation expected for oil, gas and banks

- US stocks have gained, while bonds have dropped

Inflation risks

We argued before the election that several of Trump’s proposed policies increase inflationary risks in the US, while none substantially reduce them. That’s the key reason this victory adds to the risks for US government bonds and, to a lesser extent, bonds in the rest of the world too.

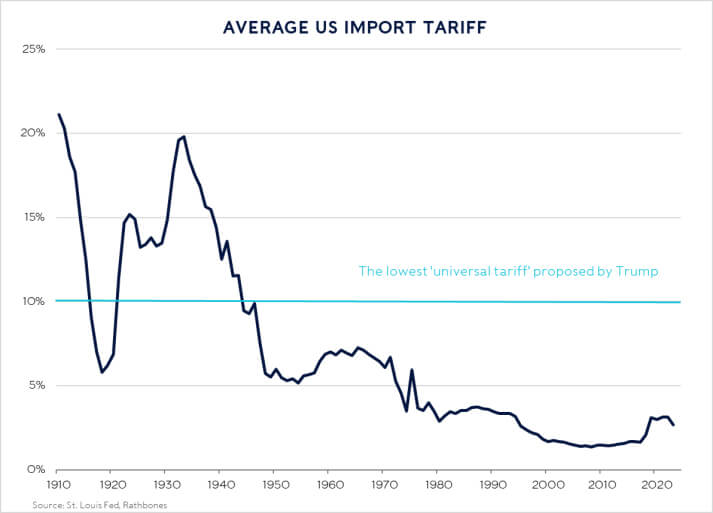

On the trade front, for example, Trump is proposing much higher and broader tariffs than those currently in force. Since the start of the trade war with China in 2018, the US has largely taken a targeted approach, focusing on strategic goods and sectors. Trump’s proposal for a ‘universal tariff’ of 60% to100% on all Chinese imports, and of 10% to 20% on all imports from the rest of the world, would mark a significant escalation. It would roughly treble the average tariff rate in the US, taking it back to levels last seen in the 1940s.

Such a sharp increase would have a significant one-off inflationary impact. We estimate it could raise the headline rate of inflation by between 1.0 and 1.6 percentage points, and that’s before factoring in any ‘second round’ effects (such as the potential knock-on implications for wage negotiations). Admittedly, the universal tariff may well not be implemented in full. That was the pattern of trade negotiations during Trump’s first term, with a combination of lobbying and negotiations with China helping to water down his initial threats. However, the direction of travel on tariffs is clear. And this is an area where a President has significant executive authority.

The experience of Trump’s first term and his pledges on the campaign trail this time also suggest that immigration will be significantly lower under his leadership. Net migration to the US fell sharply when he was in office previously, even before the pandemic. And Trump has talked about a variety of measures designed either to reduce immigration or the ability of immigrants to work in the US. This is another area where he has significant executive authority too. His website sets out plans to end the current ‘catch-and-release’ immigration policy and to restore his 2019 ‘Remain in Mexico’ programme (which forced asylum seekers to wait in Mexico rather than the US for the resolution of their cases).

He also intends to end automatic (‘birthright’) citizenship for the US-born children of illegal immigrants. And he may redeploy some tools he used when he was in office previously to reduce legal migration. He cut refugee resettlement caps far below their current levels and used executive orders to reduce visa issuance (albeit the latter mainly in the unusual circumstances of the pandemic). This matters to the economy because immigration makes a big difference to the supply of labour. More than half the rebound in the US labour force since the pandemic has been due to foreign-born workers, helping to ease the acute shortages of workers that developed in 2021. Sharply restricting immigration would probably result in higher wage growth, particularly in sectors like agriculture, construction, transport and healthcare.

Tax cuts

Meanwhile on the fiscal policy front, Trump plans to roll over the personal tax cuts he passed under his 2017 Tax Cuts and Jobs Act, which were otherwise slated to expire in 2025. And his campaign has suggested reducing the corporate tax rate again. The headline rate was cut from 35% to 21% during Trump’s first term. Now a rate of 15% is reportedly under consideration. The result would probably be even looser fiscal policy in the US, although by how much is not clear –that depends on other choices, including what is done with any additional tariff revenue raised. The government bond market may be less forgiving of much looser fiscal policy than it was in the 2010s, with the deficit already very large by historical standards (at 6.2% of GDP in 2023), the ratio of debt to the size of the economy (excluding the US Federal Reserve’s (Fed) holdings) the highest since just after the Second World War, and high inflation fresh in investors’ memories.

In contrast, Trump’s proposals to deregulate the US fossil fuel sector (more onthese below) could make a difference to inflation in the opposite direction, by boosting the supply of oil. But the overall effect is likely to be marginal compared with the other factors above. The fall in the oil price the day after the election has been very small. And production decisions outside the US are still much more important, with OPEC and its allies accounting for more than twice as much supply as the US. Otherwise, Trump’s support for scrapping restrictions on US natural gas exports could lower global prices, but would probably raise them in the US (where the existing export restrictions have kept them artificially low).

Finally, Trump’s return raises the prospect of a couple of other policy changes relating to the central bank and the dollar, which would also ultimately contribute to higher inflation. When he was last in office, Trump was far more willing than any other recent President to attempt to influence the Fed’s policy, usually pressing it to lower interest rates. His recent statements, including threats to replace Fed Chair Jerome Powell, suggest that this will continue in his second term. While his previous attempts to sway the Fed had little impact –and there are significant legal safeguards to its independence –there’s a chance that it could be different this time around. The outcome may hinge of the behaviour of the Senate, as the Republican-controlled upper house rejected three of Trump’s nominations to the Fed interest-rate-setting board last time. If the central bank becomes more politicised, that could pave the way for lower interest rates and intervention to limit the strength of the dollar. History suggests that the result would ultimately be higher inflation and more economic volatility.

US stocks welcome Trump

US stock futures have risen on the news of Trump’s victory, probably buoyed by the prospect of lower corporate taxes and the Democrats’ proposal to raise the headline rate back to 28% coming off the table. Corporate tax cuts were a key reason for the strong performance of US equities during Trump’s first term in office too, and it took some time for the effect to be fully reflected in prices. For a firm paying the headline rate of corporate tax, the proposed cut to 15% would boost post-tax profits by about 8%, whereasthe Democrats’ proposal would have reduced them by about 9%. To put that into context, 8% is roughly a year’s profit growth for an average US listed company.

That said, the current backdrop is different to 2016 when Trump was first elected. The proposed cut to corporate taxes is smaller this time than last. The stock market is starting from a higher valuation. And markets more generally may be less forgiving of policies which increase inflation and the deficit than

they were then. Trump’s agenda looks less favourable for stocks outside the US. They’ll benefit less (if at all) from lower US corporate taxes and face the threat of tariffs. European stocks have generally risen since Trump’s victory, but by less than their US counterparts,while Chinese markets have fallen.

Otherwise, Trump’s victory creates uncertainty about the future of the huge industrial policy programmes passed under President Joe Biden’s administration. This may have significant implications for specific firms and sectors. Parts of Biden’s programme are probably safe. The 2021 Infrastructure Investment and Jobs Act received bipartisan support. So did the 2022 CHIPS and Science Act. Although Trump criticised it in the days before the election, Republican lawmakers (including some who voted against it) have praised the spending it has catalysed in their districts.

In contrast, the misleadingly named Inflation Reduction Act (which is first and foremost a landmark piece of climate legislation, providing huge grants and tax credits for investment in electric vehicles and clean power) was universally opposed by Republicans in both the Senate and the House. It has also been criticised repeatedly by Trump. The electric vehicle incentives the act provides look particularly vulnerable. The share prices of clean energy providers have suffered on the news of Trump’s victory, but there may be more hope for the Inflation Reduction Act’s clean energy subsidies. Remarkably, the investment from those subsidies has flowed mainly to Republican parts of the country. Republican Texas, for example, installed more solar capacity than any other state in 2023.

Deregulation for oil, gas and banks

Trump’s return changes the regulatory outlook for several sectors too. When in office previously, he loosened regulation for mid-size banks. Think-tanks associated with his campaign have called for broader deregulation this time, including repealing parts of the Dodd-Frank Act passed in the aftermath of the Global Financial Crisis which targets the largest institutions. Trump would probably also relax rules for the fossil fuel industry. He is likely to rescind Biden-era orders which restrict fossil fuel leases on federal land, including in the Arctic. He would also limit litigation against energy development and expedite approvals for new projects, including specific ones such as natural gas pipelines into the Marcellus Shale in Pennsylvania, West Virginia and New York.

These potential regulatory changes are clearly being reflected in the initial market reaction. Yet, as long-term investors, it’s important not to overemphasise them. The pattern of sectoral performance in recent years has been the exact opposite of what you would expect based on sitting presidents’ regulatory preferences alone. The financial and energy sectors underperformed during Trump’s term and outperformed under Biden. Other factors, like shifts in the global oil price because of the pandemic and war in Ukraine, ultimately made a much bigger difference. Something similar has been true of the shift towards a tougher antitrust regime under the Biden administration, which hasn’t stopped the very largest stocks from outperforming. (Trump’s stance here isn’t completely clear, with Republicans divided on this issue, although his running-mate JD Vance has praised Biden’s antitrust enforcer Lina Khan.) It has paid to focus more on the broader investment context than narrowly on changes in the US regulatory environment.

The return of Trump could have profound effects on markets and the environment that businesses and households must operate in. We’ll learn much more in the coming months as Trump’s team takes shape and the remaining Senate and House results arrive. As ever, there will be loud voices on both sides, one emphasising the pros and the other the cons. But experience suggests that investors should stay focused on the broader drivers of long-term performance, and be wary of overreacting to short-term moves around the vote, particularly when it comes to choosing between sectors.

Click here to download this article as a pdf.

Important information

Information valid at November2024, unless otherwise indicated.

This document and the information within it does not constituteinvestment research or a research recommendation.

Rathbones Investment Management International is the Registered Business Name of Rathbones Investment Management International Limited, which is regulated by the Jersey Financial Services Commission. Registered office: 26 Esplanade, St. Helier, Jersey JE1 2RB. Company Registration No. 50503.

Rathbones Investment Management International Limited is not authorised or regulated by the Prudential Regulation Authority or the Financial Conduct Authority in theUK. Rathbones Investment Management International Limited is not subject to the provisions of the UK Financial Services and Markets Act 2000 and the Financial Services Act 2012; and, investors entering into investment agreements with Rathbones Investment Management International Limited will not have the protections afforded by those Acts or the rules and regulations made under them, including the UK Financial Services Compensation Scheme.

This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument by Rathbones Investment Management International Limited. The information and opinions expressed herein are considered valid at publication, but are subject to change without notice and their accuracy and completeness cannot be guaranteed. Not for distribution in the United States. Copyright ©2023 Rathbones Group Plc. All rights reserved. No part of this document may be reproduced in whole or in part without express prior permission.

Rathbones and Rathbone Greenbank Investments are trading names of Rathbones Investment Management Limited, which is authorised by the PRA and regulated by the FCA and the PRA. Registered Office: Port of Liverpool Building, Pier Head, Liverpool L3 1NW. Registered in England No. 01448919. Rathbones Investment Management Limited is a wholly owned subsidiary of Rathbones Group Plc.