Sails and sales

Last month was the anniversary of a key COVID-era moment.

No, not the first lockdown … I’m instead talking about the Ever Given getting stuck in the Suez Canal.

Partly, because if you love memes as much as we do, this was payday.

And partly because it illustrated how fragile the global trade system was. One ship, in the wrong place (very wrong place), and everything stopped.

4 years on, though, it might be worth reconsidering that word “fragile” – or at least the timeframe over which it applies.

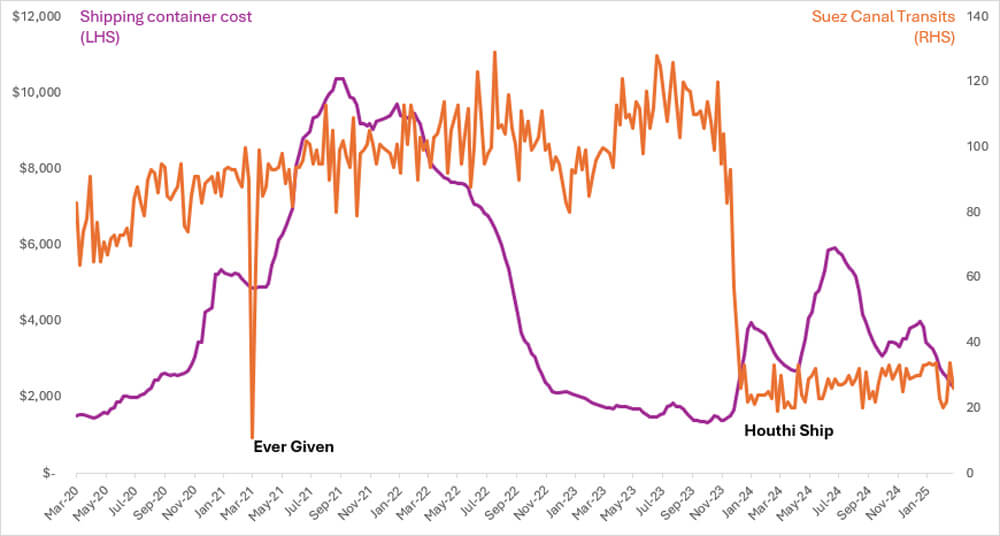

In 2021, the number of transits through the Suez Canal essentially stopped until the Ever Given was freed – in the week it was stuck for, only 11 ships passed through the canal, vs a normal week of around 90-100.

Add that to the chaos of COVID closing ports across the world, and the price of a shipping container went up from $1,500 to over $10,000.

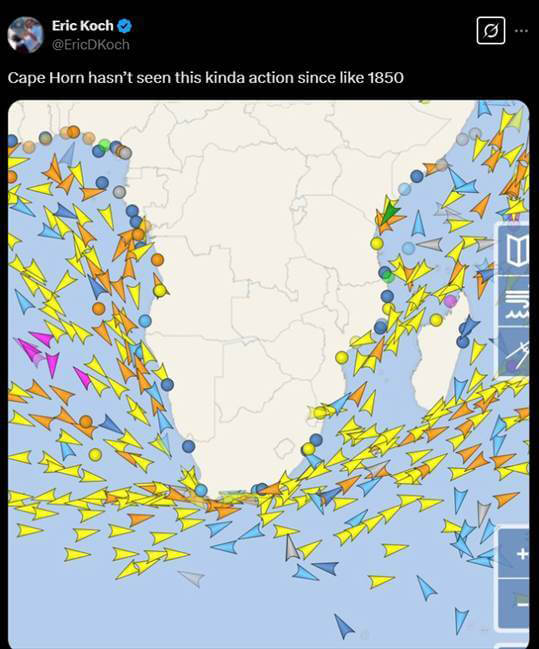

Companies were forced to come up with back-up plans; with new shipping routes and fuel strategies and goods distribution capacity.

In 2023 about 30% of all the world’s container goods passed through the Suez Canal. And then, armed attacks in the Red Sea began, reducing traffic by about 80%. Companies like Maersk just don’t use the Canal anymore – it’s too risky.

And the resilience built during Ever Given haven’t been forgotten. Rerouting happened instantly. Other ports increased capacity. Trade continued and container prices today are only slightly above where they were in 2023 ($2,000 per container, rather than $1,700).

It’s something worth remembering when headlines are screaming about trade disruption from Trump and tariffs.

Someone will always find a way to get what’s needed to where it needs to be, as cheaply as possible:

The global trade system is VERY hard to block. No matter how big your boat, or how tough your tariffs.